Buy the Best Airbnb Properties With Heat Map Analysis

The success of every real estate investing endeavor starts with buying the best rental property. This holds true for Airbnb rentals too, which have been growing in popularity in the past few years. If you are tempted to join the pool of successful Airbnb income properties investors in the US housing market, you have come to the right place. We will show you how to use real estate heat map analysis, one of the hottest must-have tools in real estate, to buy a profitable Airbnb rental property at the beginning of 2019. That’s the most straightforward and secure track to high Airbnb rental income, cap rate, and cash on cash return.

But first things first…

What Is Heat Map Analysis in Real Estate Investing?

Most of us already know what a heat map is. It’s a user-friendly, two-dimensional, visual representation of data using different colors to mark different value ranges. The most important feature of heat map analysis is that it summarizes big data in a way accessible to just about everyone.

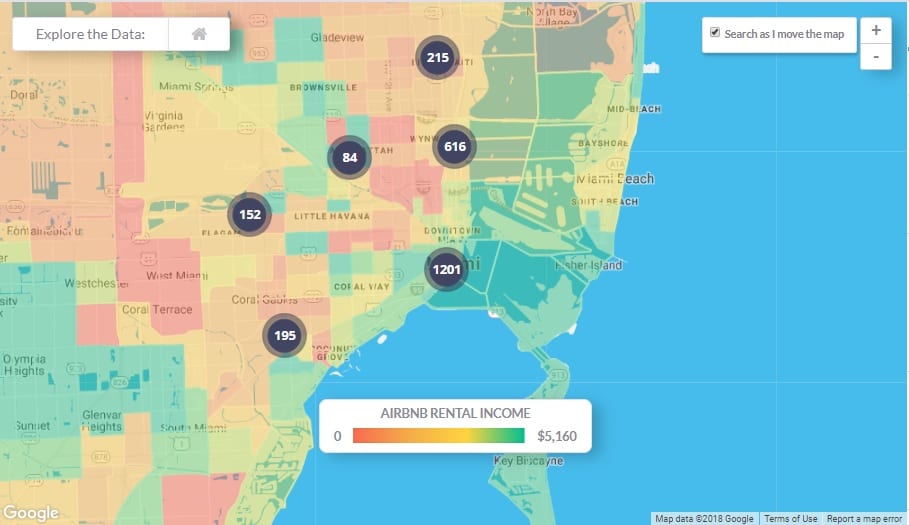

A real estate map does the same with real estate data. Let’s take a look at Mashvisor’s heat map analysis tool as an example:

There are a number of criteria based on which you can filter your property search on Mashvisor’s heat map tool. These include:

Advertisement

Listing price: Although the listing price is not necessarily the exact price for which you will be able to buy an investment property for sale, it is a good approximation, unless you are looking at an extreme buyer’s market or seller’s market. Naturally, the property price is a crucially important factor for the return on investment of your rental property. It determines all major return metrics such as the Airbnb cash on cash return, cap rate, and rate of return. Moreover, the price which you pay for your investment property first will determine how much money you will be able to make in the long term, once you decide to sell your property. Whether you invest in traditional rentals or Airbnb rentals, appreciation is one of the best strategies to make money with real estate in the long run.Airbnb cash on cash return: The cash on cash return is a profitability metric mostly used in the real estate investments business. It shows an Airbnb host what his/her return will be based on the money he/she spends in cash when buying an investment property. This is different from the cap rate, which looks at the sale price or the current market value of the property.Airbnb rental income: In addition to the property value, the Airbnb rental income is the second most important factor determining the profitability of your short-term rental property. The higher the nightly rate for your Airbnb, the higher the rental income, and the higher your return on investment.Airbnb occupancy rate: Last but not least, the Airbnb occupancy rate shows you how much you can raise your nightly rate before this starts affecting your rental income negatively. As a successful real estate investor, you have to learn to find the balance between the nightly rate and the occupancy rate. And that’s something heat map analysis can definitely help you with.

Mashvisor’s heat map analysis marks the low value areas in red and the high value areas in green, with the middle value areas being in orange and yellow.

As you can tell from the image above, Mashvisor’s heat map generator replaces the need to conduct neighborhood analysis, which is a tedious, time-consuming, and costly process. Instead, it provides real estate investors looking for the best place to buy an Airbnb rental property with readily available analytics.

To make the best real estate investment decisions, combine the power of heat map analysis with an Airbnb profit calculator.

How to Use Heat Map Analysis to Make the Best Real Estate Investment Decisions

By doing the real estate market analysis in general and the neighborhood analysis in specific for you, Mashvisor’s heat map generator facilitates the process of buying a profitable Airbnb income property. But how exactly?

Listing Price

Most real estate investors, especially beginners, buy on a tight budget. Regardless of whether you will pay in cash or go for a mortgage or another more creative financing strategy, you always have a certain budget. Once you establish your budget, heat map analysis will point you to the neighborhoods in your city of choice where you can afford buying an investment property. This will save you lots of time (as you don’t have to look into neighborhoods which are not affordable for you) and will give an early direction to your property search.

Here you can find some affordable markets for buying an Airbnb property.

Airbnb Cash on Cash Return

The only reason why anyone would want to invest in real estate is to make money. Airbnb rentals have turned into a great way to do that, but not all properties for sale have the same potential for return when rented out on Airbnb. Mashvisor’s heat map analysis will show you the neighborhoods where Airbnb rentals get the highest cash on cash return, on average, so that you can focus on this area in your property search. There is no point to waste time on locations which will just not bring you the expected cash on cash return.

These are the best cities for Airbnb investments for cash on cash return in 2019.

Airbnb Rental Income

As an Airbnb host, you should care not only about your cash on cash return but also the rental income which your property is generating. After all, it does matter whether you make $100 or $1,000 in Airbnb rental income per month. With a heat map generator you can easily find the locations within your real estate market of choice where Airbnb income properties yield high income for landlords.

Read some tips and tricks on how to boost your Airbnb rental income!

Airbnb Occupancy Rate

Even if you buy the best investment property in town, you will only make money from it if you are able to start renting it out on Airbnb. This means that you should always go for properties for sale in locations which enjoy high Airbnb occupancy rate. How to find them? With Mashvisor’s heat map, of course!

Here is what Airbnb occupancy rate you can expect in 2019 in the US housing market.

Investing in Airbnb rentals has been an optimal strategy in many US housing markets in the past decade. The trend is likely to continue in 2019 and beyond, despite tightening short-term rental regulations in some parts of the country. The first step to start an Airbnb business successfully is to buy a good property in a profitable location. How to do that? With Mashvisor’s heat map analysis, which will save you time, money, and efforts. Finding income properties to rent out on Airbnb has never been easier and more efficient!

In case you are more of a traditionalist when it comes to real estate investing and would rather go for buying a long-term rental property in 2019, a heat map analysis tool can still be of help.

Start Your Investment Property Search! AirbnbCash on Cash ReturnHeatmapOccupancy RateProperty PricesRental Income

Leave A Comment